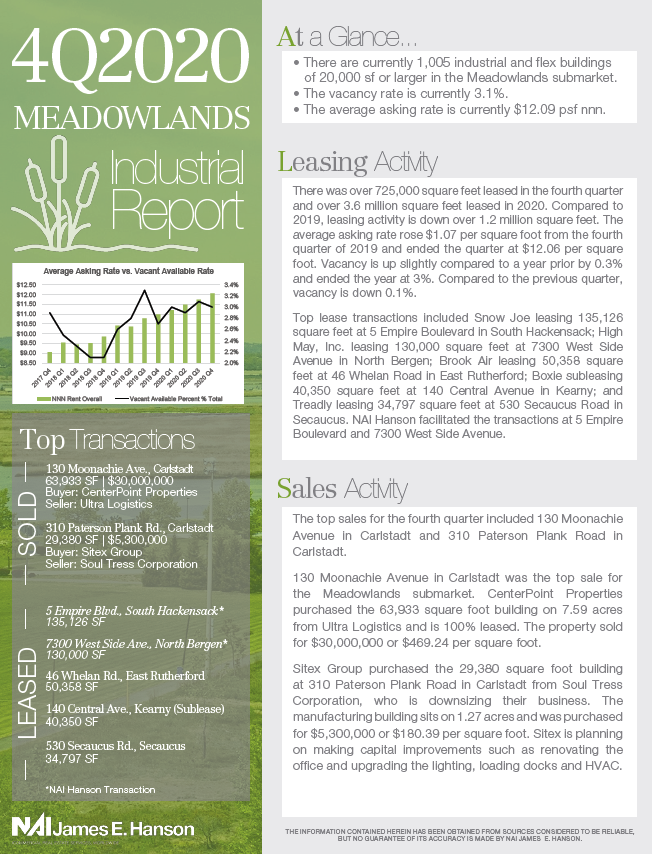

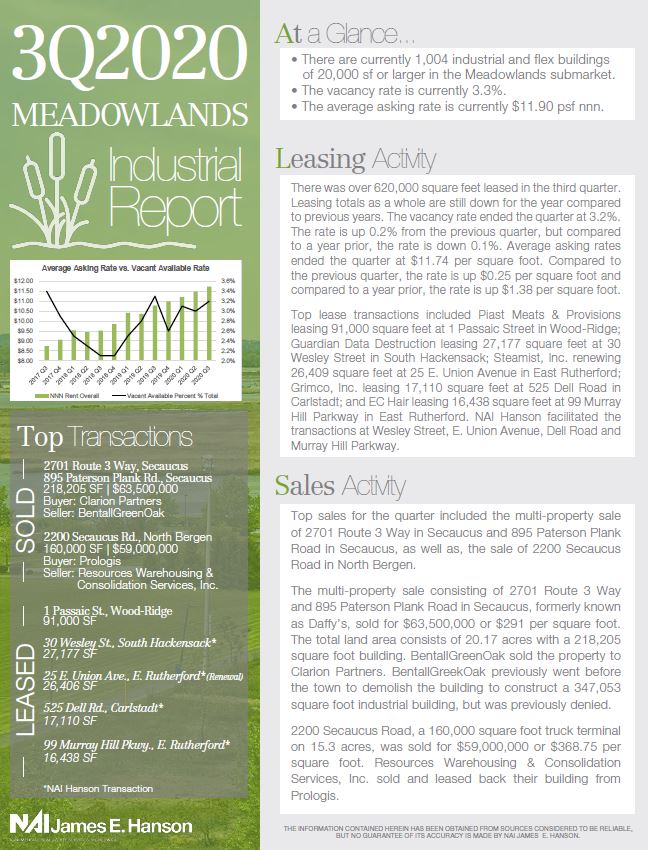

Market Reports

NAI Market Information provides current demographic and property statistics, as well as a comprehensive market analysis, for more than 400 global markets. The information is gathered by NAI professionals in key markets and compiled in the NAI Global Market Report, published annually with quarterly updates provided online.