Previous Market Reports

NAI James E. Hanson provides property statistics, demographic information, economic analysis, and comprehensive market intelligence for the Northern & Central New Jersey real estate markets. The information is gathered by NAI professionals and compiled in our quarterly industrial, office and medical office reports.

2025 Market Reports

The Northern New Jersey industrial market has entered a period of adjustment with slowly rising vacancy rates, stable asking rents and a decrease in speculative construction deliveries. Demand for high-quality space has been the main driver of activity.

Demand for premium and trophy space, driven by a continued flight to quality, has been the main catalyst for leasing activity. Older buildings continue to face challenges as tenants seek high-quality and amenity rich properties.

After reaching a historical high of 6.7% a year ago, the vacancy rate in the Meadowlands stabilized over the last few months, closing the third quarter at 6.0%. The decline in the vacancy rate is partially attributable to a slowdown in the amount of new construction deliveries and steady leasing activity.

Vacancy rates continue to rise in most submarkets. After reaching a historical low of 2.0% in 2022, the overall rate has slowly but consistently risen, reaching 5.9% at mid-year.

Statistically, there was little change in the New Jersey office market during the first six months of the year, with vacancy and rents remaining relatively flat. Leasing activity, meanwhile, has largely been driven by a flight to quality.

The Meadowlands was only one of five submarkets in Northern New Jersey that posted positive absorption at mid-year. The vacancy rate in the Meadowlands eased a bit during the first half of the year, closing at 5.9%, down from 6.3% at the same time last year.

The Northern New Jersey industrial market appears to have entered a period of balance after several years of unprecedented growth and despite the macroeconomic uncertainty around increased tariffs.

There was little change in the New Jersey office market during the first quarter, with vacancy and rents remaining relatively flat from year-end 2024.

After rising for nine consecutive quarters and reaching a historical high at the end of 2024, the vacancy rate in the Meadowlands eased a bit during the first quarter, closing at 6.4%, down from 6.7% at the end of last year.

2024 Market Reports

The New Jersey industrial market continued to be impacted by sustained deliveries of new product throughout 2024. Available space in new construction has kept absorption in negative territory over the last seven quarters. In addition to offerings from new construction, the amount of sublease space rose throughout the year.

New Jersey office market conditions were relatively unchanged throughout the year with vacancy rates and asking rents showing little movement. Year-over-year, however, the market has had shown some positive signs. Leasing activity has largely been driven by a flight-to-quality, which has helped to sustain momentum.

The vacancy rate in the Meadowlands continued to rise throughout 2024, closing the year at 6.7%. The rise during the fourth quarter marked the ninth consecutive quarter of increasing vacancy. Higher vacancy has been the trend for most submarkets in Northern New Jersey, due in large part to deliveries of new construction.

In what is typically the slowest part of the year, demand for industrial space remained robust through the third quarter. Average asking rents, which experienced a sustained period of growth over the last several quarters, have leveled.

Office market conditions were relatively unchanged through the third quarter with vacancy rates and asking rents showing little movement. Asking rents remain highest along the Hudson Waterfront where there are several large block availabilities in trophy properties.

The vacancy rate in the Meadowlands rose during the third quarter, mirroring the trends of most of Northern New Jersey. Deliveries of new construction have added nearly 800,000 square feet to the submarket so far this year.

Rising vacancy rates amid new construction deliveries and tempered demand were the key trends in the New Jersey industrial market in the first half of the year, while average asking rents moderated.

The ongoing flight to quality has helped to sustain leasing activity in the Northern New Jersey Office market through the first half of the year. Tenants in the market continue to focus on upgrading their occupancy to Class A and trophy properties.

The overall vacancy moved higher during the second quarter—rising for a fifth consecutive quarter. At 6.3% the vacancy rate is now at its highest level since 2014. Overall vacancy has risen across most of the submarkets in Northern New Jersey, not just in the Meadowlands.

The overall vacancy rate rose during the first quarter up to 5.0%, from 4.7% at the end of last year and from 2.4% at the end of the first quarter 2023. The rise in the vacancy rate is the result of the delivery of 4.6 million square feet of new product during the quarter, where 69.0% of space is available.

Many of the trends that occurred at the end of 2023 continued into the first three months of 2024. A flight to quality has helped to sustain the market as active tenants look to upgrade their space by relocating to Class A and trophy properties.

The overall vacancy moved higher during the first quarter, closing at 5.9%–its highest level since 2016. Overall vacancy has risen across most of the submarkets in Northern New Jersey, not just in the Meadowlands, due in large part to the delivery of new construction.

2023 Market Reports

2022 Market Reports

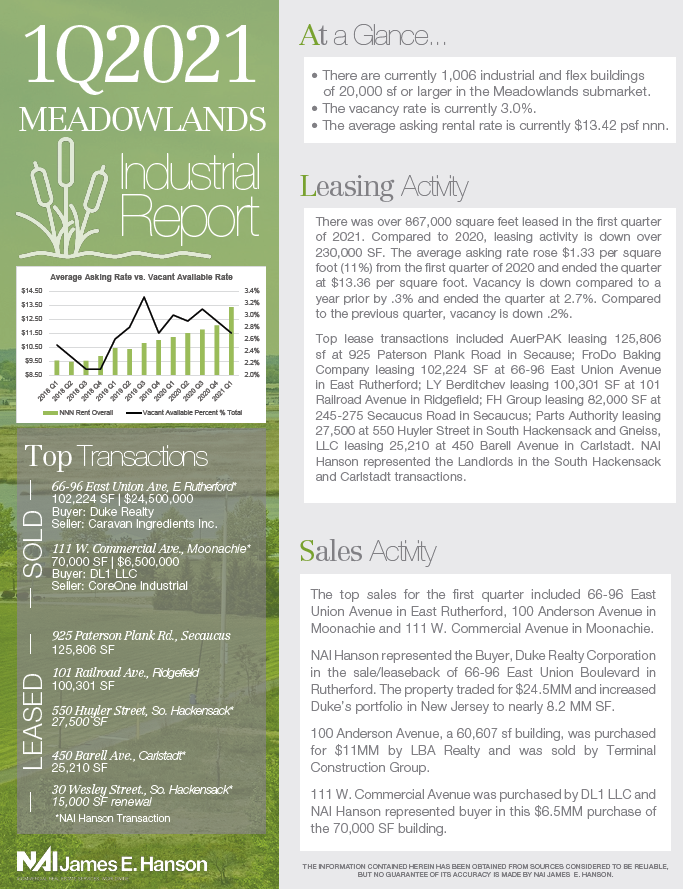

2021 Market Reports

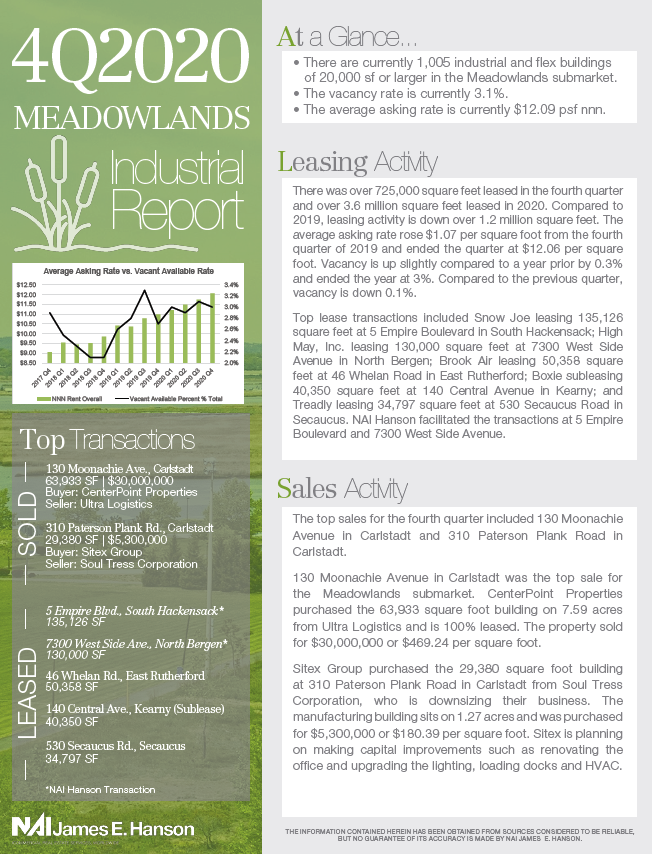

2020 Market Reports